Over the past few weeks, the phrase “Federal $2,000 Deposit” has gained widespread attention. Many people believed this amount would arrive as a separate payment in early 2026, similar to earlier stimulus checks. For households dealing with rising living costs, the idea of extra money felt like much-needed relief. However, recent updates show that the situation is more complex than early social media claims suggested.

Not a Standalone Payment

One of the biggest misunderstandings is how this $2,000 would be paid. It is not designed as a universal cash deposit sent to everyone. Instead, the proposal treats it as a tax-related relief credit. This means eligibility would depend on factors such as income level, filing status, and tax return details. The credit is expected to be connected to 2025 tax returns that are filed during the 2026 tax season.

Major Change in Payment Timing

Earlier expectations suggested the $2,000 would arrive separately after regular tax refunds. That assumption has now changed. The latest guidance indicates that the amount would be included directly in the main tax refund. Instead of two payments, eligible taxpayers would receive one combined refund that already includes the credit.

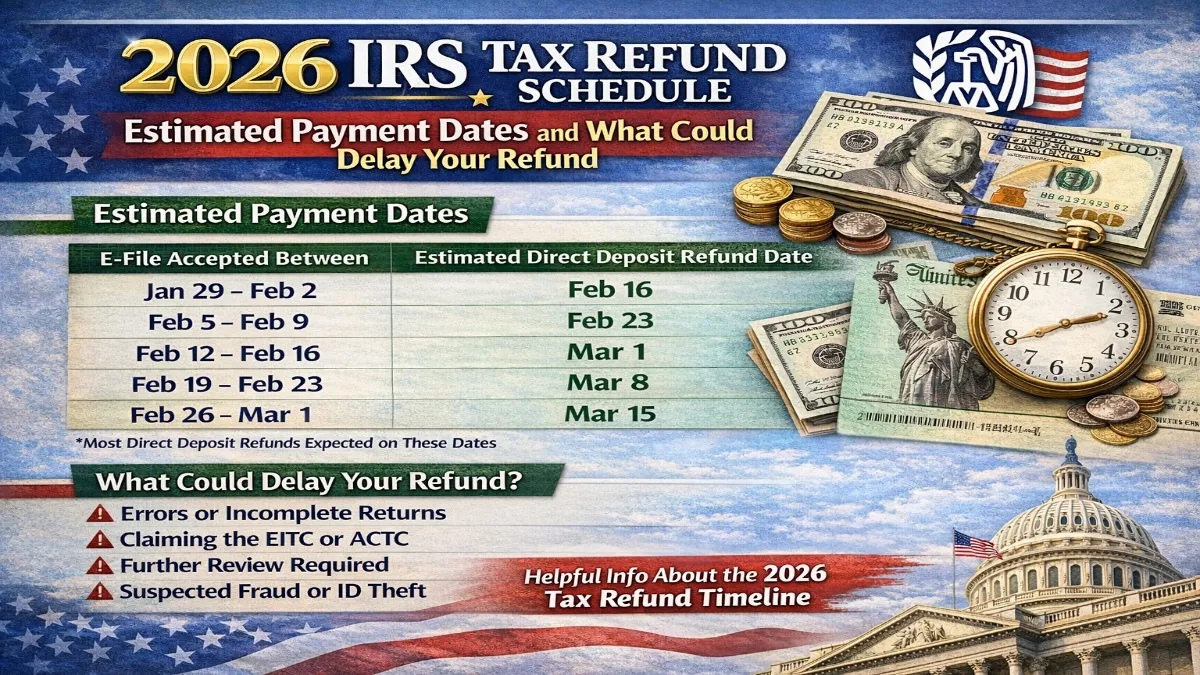

Because of this integration, the IRS needs extra time to update processing systems. As a result, the 2026 tax filing season may start later than usual, possibly in mid or late February. This delay could affect taxpayers who normally receive early refunds.

How Refunds May Be Affected

With the credit included in the refund, processing times may be longer. High-value credits usually trigger additional verification to prevent errors and fraud. Even small mistakes on a tax return could cause delays. Taxpayers who depend on early refunds may need to adjust their financial plans and prepare for a longer wait.

How to Prepare for the 2026 Tax Season

Preparing early can help reduce delays. Keeping income records accurate and consistent is important. Filing only after the IRS officially opens the season for all forms can also prevent rejections. Once filed, refund tracking tools will show the total refund amount, not a separate $2,000 payment, so understanding this detail can prevent confusion.

Setting Realistic Expectations

While the idea of quick relief was encouraging, the updated timeline suggests patience will be required. Treating any additional refund as a later financial resource rather than early-year income can make planning easier. Clear information allows better decisions and reduces stress.

Conclusion

The Federal $2,000 Deposit has not been canceled, but its structure has changed. It is now expected to be part of the regular tax refund, with possible delays in the 2026 filing season. Understanding these changes helps taxpayers plan wisely and avoid disappointment.

Disclaimer: This article is for informational purposes only. Tax laws and proposals can change, and eligibility rules may vary. For official updates and personal guidance, always refer to IRS announcements or consult a qualified tax professional.