As January 2026 approaches, many Americans are noticing IRS direct deposits showing amounts close to $2,000. This has created confusion and speculation about whether a new federal stimulus payment has been approved. While the number sounds familiar, the truth is more straightforward. The Internal Revenue Service has not announced any new universal $2,000 stimulus check for January 2026. Instead, these deposits are connected to regular tax refunds and existing tax credits.

No New $2,000 Stimulus Has Been Announced

There is currently no nationwide $2,000 stimulus payment planned or approved by the federal government for January 2026. The IRS has made no official statement confirming a new relief check. Any deposit showing this amount is not a bonus or special payment. It is part of the standard tax refund process linked to individual tax returns.

Why the $2,000 Amount Keeps Appearing

The most common reason people see a deposit near $2,000 is the Child Tax Credit. Eligible taxpayers can receive up to $2,000 per qualifying child when they file their 2025 tax return during the 2026 tax season. This credit is included in the total tax refund and is not sent separately. In some cases, taxpayers without children may also receive refunds close to this amount due to tax overpayments or other refundable credits.

Who May Qualify for a $2,000 Refund

Eligibility depends entirely on personal tax details. Factors such as income level, filing status, number of dependents, and total taxes paid throughout the year all play a role. There is no automatic payment. To receive any refund, including one that totals $2,000, taxpayers must file a federal tax return for the 2025 tax year.

When Refunds Could Arrive

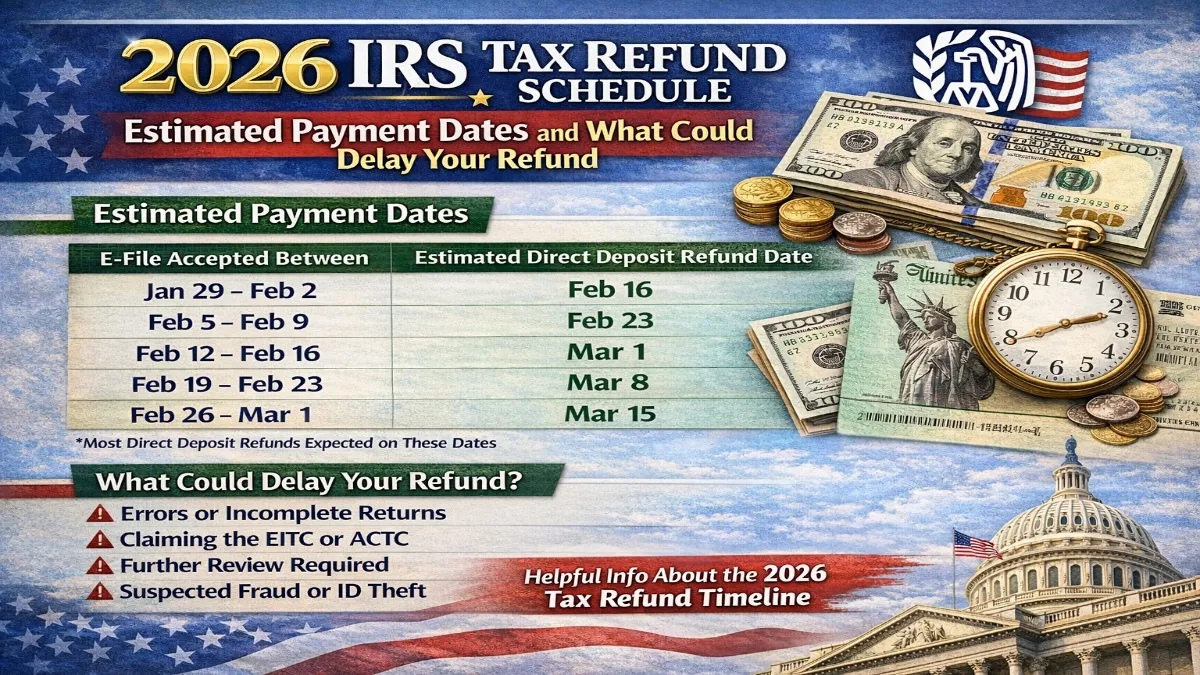

For most people who file electronically and choose direct deposit, IRS refunds are usually issued within 21 days after the return is accepted. Early filers may start seeing refunds in early February 2026, with many payments arriving by mid to late February or March. Returns that include certain credits or require additional review may take longer to process.

Reasons Refunds May Be Delayed

Refunds can be delayed if there are errors on the tax return, mismatched income information, identity verification checks, or if the return is filed on paper. Claims involving the Child Tax Credit or other refundable credits may also require extra processing time.

Final Thoughts

The $2,000 IRS direct deposit being discussed in January 2026 is not a new stimulus payment. It usually reflects a regular tax refund or the Child Tax Credit included in early 2026 refunds. Understanding this difference can help taxpayers avoid confusion and unrealistic expectations.

Disclaimer

This article is for informational purposes only and does not provide tax, legal, or financial advice. IRS rules, refund timelines, and tax credits are subject to change. Individual refund amounts depend on personal tax situations. Readers should consult official IRS resources or a qualified tax professional for guidance specific to their circumstances.