As the 2026 tax season approaches, millions of Americans are eager to know when their IRS tax refunds will arrive. For many households, refunds are an important financial boost used to pay bills, reduce debt, or save for emergencies. While the IRS does not provide exact dates for each taxpayer, understanding how the refund process works can make tax season less stressful.

When you file your federal tax return, the IRS begins processing it once it is received and accepted. Electronic filing allows the IRS to process returns faster than paper submissions. The accuracy of the return also affects timing. Mistakes or missing information can slow the process, while accurate filings move through the system more smoothly.

Direct Deposit vs. Paper Checks

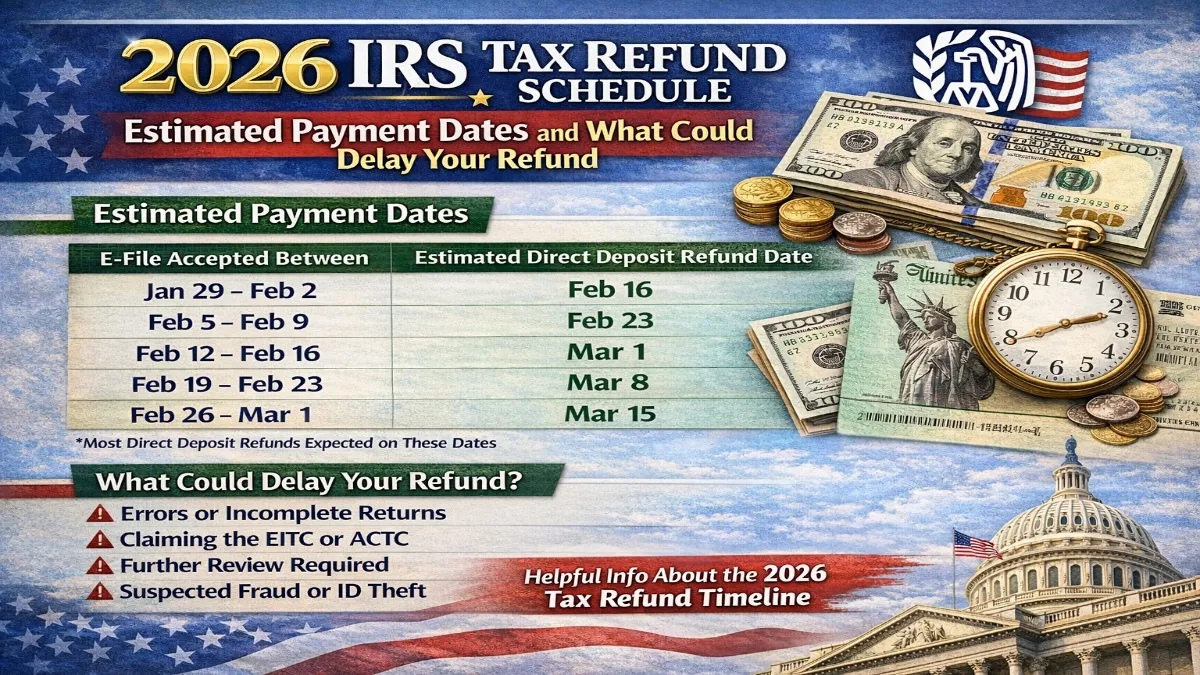

How you choose to receive your refund plays a big role in timing. Direct deposit is the fastest and most secure method, often allowing taxpayers to see their refund within two to three weeks of an electronically filed return being accepted. Paper checks, however, take longer due to mailing and postal delays. Taxpayers who want faster access to their refund should choose direct deposit when filing.

Why Refunds Are Delayed

Refund delays are common and usually result from issues with the tax return. Incorrect Social Security numbers, calculation errors, or mismatched income information can trigger additional review. Identity verification is another factor, as the IRS conducts security checks to prevent fraud. During peak filing periods, high volumes of returns can also extend processing times.

Tips to Avoid Delays

Filing early can help, as the IRS processes early returns when systems are less crowded. Ensuring that all information is accurate, responding promptly to IRS notices, and using direct deposit are the most effective ways to reduce delays. Taxpayers should avoid filing the same return multiple times unless instructed by the IRS, as this can create further complications.

Tracking Your Refund

The IRS provides official online tools to track the status of your refund. These tools update regularly and are the most reliable source of information. Checking third-party websites or social media claims can be risky and may lead to misinformation.

Expected Timeline

Most taxpayers can expect their 2026 refunds to arrive between late January and April. Exact timing varies depending on when the return is filed, how it is submitted, and whether the IRS needs to review it further. Staying informed and prepared can help taxpayers navigate the season with confidence.

Disclaimer:

This article is for informational purposes only and does not constitute tax, legal, or financial advice. IRS refund timelines, processing procedures, and tax laws may change. Individual refund dates depend on personal circumstances and IRS review processes. Taxpayers should consult official IRS resources or a qualified tax professional for guidance specific to their situation.