As January 2026 approaches, many Americans are seeing news about a possible $2,000 deposit from the IRS. Social media and online headlines often describe it like a new stimulus check, causing confusion. In reality, this is not a nationwide payment sent to everyone. Understanding what the deposit actually represents can help taxpayers set realistic expectations and avoid misinformation.

What the $2,000 Deposit Really Means

The $2,000 figure is often linked to tax refunds, refundable credits, or adjustments from previous filings. Some taxpayers may see amounts around $2,000, but the number is not guaranteed. It depends on income, tax credits, dependents, and other individual filing details. Essentially, the deposit represents normal IRS payments that may add up to approximately $2,000 for some people, rather than a new government program.

Who May Be Eligible

Eligibility depends on each taxpayer’s filing and credit situation. Individuals who file accurate and complete returns on time generally have faster processing. Those eligible for refundable credits based on income, dependents, or past adjustments may see larger payments. The IRS determines eligibility individually, so not everyone will receive a deposit, and amounts can vary widely.

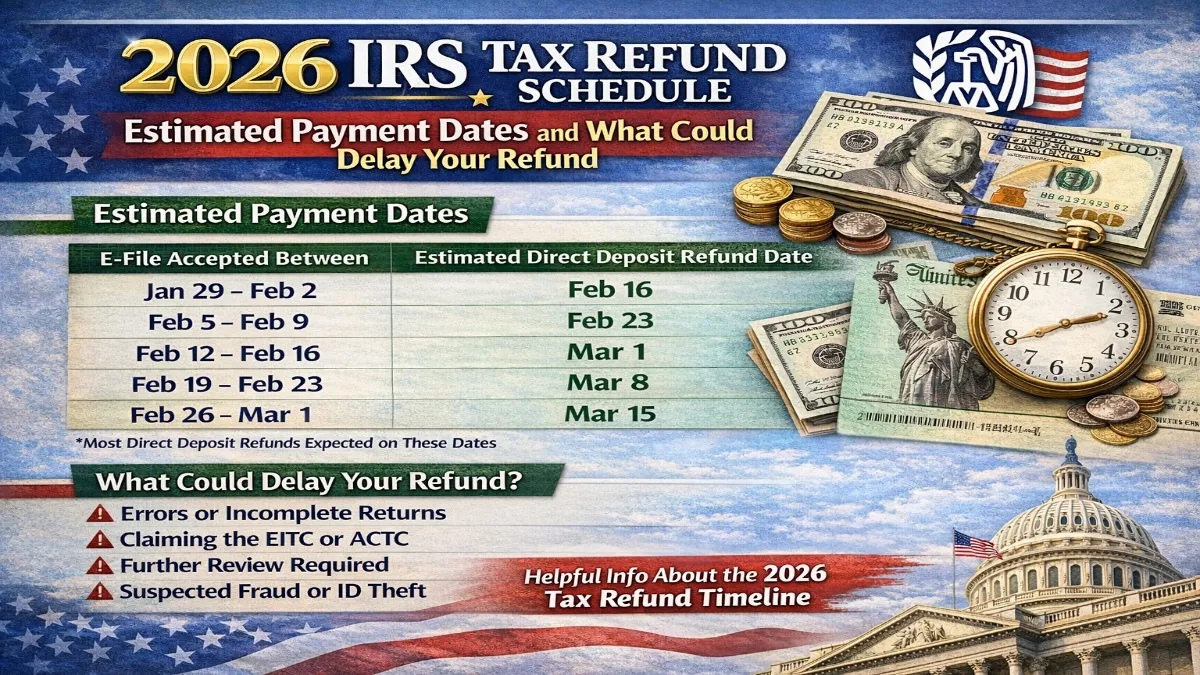

When Payments Are Expected

IRS payments are distributed throughout January, depending on when returns are processed. Taxpayers who file early and choose direct deposit usually receive funds first. Paper checks take longer to arrive. Delays can happen if the IRS needs to verify information or resolve errors. Ensuring bank details and mailing addresses are current can help prevent delays.

Common Misunderstandings

Many believe everyone will get exactly $2,000, but amounts differ by taxpayer. Another misconception is that no action is required. Accurate filing is critical, as errors, missing information, or unfiled returns can prevent payments. The safest way to track a deposit is through official IRS tools rather than relying on social media or unofficial sources.

How to Stay Prepared

To avoid problems, taxpayers should double-check their filings, confirm banking and mailing information, and respond promptly to any IRS notices. Consulting the IRS website or a qualified tax professional can provide guidance tailored to individual circumstances. Being informed ensures realistic expectations and helps avoid unnecessary stress during tax season.

Disclaimer

This article is for informational purposes only and does not provide financial, tax, or legal advice. There is currently no universal $2,000 IRS stimulus payment announced for January 2026. Eligibility, amounts, and payment schedules depend on individual tax situations and may change. Readers should consult the official IRS website or a qualified professional for accurate guidance.